Key Points – updated 5 March 2025

- France have massively hiked their passenger air tax rates, effective 1st March 2025, which also now extend to commercial BizAv flights – private flights are exempt.

- These new rates will mean operators must pay anywhere from €420 to €2100 per passenger, depending on where you’re flying!

- The tax applies to flights departing from both mainland France and most French overseas territories – but with some exceptions.

France has just passed its annual budget, which includes some eye-watering adjustments to the Air Passenger Transport Tax (Taxe de Solidarité sur les Billets d’Avion, or TSBA), which now extends to commercial BizAv flights (aircraft with 19 seats or less).

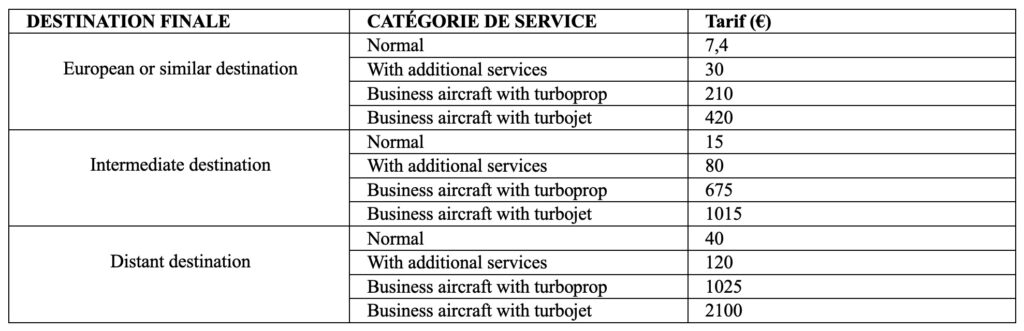

The new rates are due to take effect from 1 March 2025, and vary depending on destination. For BizAv departing from French airports, the new rates per passenger will be:

- €420 for European destinations

- €1015 for intermediate destinations (everywhere else up to 5500km)

- €2100 for long-distance destinations (beyond 5500km).

And yes, those rates are per passenger! Domestic flights within France will have to pay an extra 10% VAT on top of these rates.

The airlines are getting hit too. The budget includes a rise from €2.63 to €7.40 for an economy ticket heading anywhere within Europe, and more if you’re going somewhere farther away or are traveling in business class.

There’s a weird way they calculate the distance flown here. The new law specifies that the distance used to determine the tax will be calculated from LFPG/Paris Charles de Gaulle airport (what they call the the “national reference aerodrome of the metropolitan territory”), rather than the actual distance between departure and destination airports.

For example, if you’re flying from LFMN/Nice to KTEB/Teterboro, the tax calculation will actually use the distance from LFPG/Paris to KTEB/Teterboro instead. The idea with this weird method is that it helps give a consistent and simplified way of calculating the distance for tax purposes.

Do private flights have to pay this too?

We’re almost 100% sure they don’t.

The new tax rules list a few exemptions, including: “flights undertaken by a physical or legal person for the purposes of leisure aviation or on their own behalf.”

That sounds very much like private flights.

Also, the French tax authority has an entire website where they try to answer questions like this. The best answer comes in the March 1st FAQ which clarifies three points:

“Own-account” (ie. private) flights are not subject to the tax:

“In the case of own-account flights (i.e. private flights) involving employees or managers of the operator, or employees/managers of a company that owns 100% of the operator, these are not subject to the TS.”

Non-commercial flights are not taxable:

“Article L. 422-5 of the CIBS specifies at national level the definition of commercial flight established at European level. Under these conditions, an aircraft flight that does not fall within the definition of a commercial flight is not taxable… The economic activity criteria is not met if the activity is not carried out for valuable consideration.”

Fractional/shared ownership flights are generally considered private and not subject to the tax:

“With regard to the criteria of carrying out transport on behalf of third parties: shared/fractional ownership models are part of own-account transport…”

The doc also says that even if a flight is filed as “General Aviation” (G) in the flight plan, this does not automatically mean it is tax-exempt. It sounds like the authorities pretty much ignore how the flight plan is filed – they’re more interested in determining whether the flight truly meets the definition of non-commercial private transport or commercial transport under tax law.

What about flights from French overseas territories?

This is where it gets even more complicated! The tax applies to flights departing from both mainland France and most French overseas territories – but with some exceptions.

Flights departing from these places are exempt:

- TFFJ/Saint Barthelemy and TFFG/Saint-Martin

- New Caledonia and French Polynesia

- LFSB/Basel-Mulhouse Airport (flights operated under Swiss traffic rights from here are exempt).

The tax applies to flights departing from:

- Guadeloupe

- Reunion

- Martinique

- Mayotte

- French Guyana

For flights from these places, here’s how they calculate what rate of tax you should pay:

“European or similar destination” (€420):

- Flights within the same French overseas territory.

- Flights to mainland France and Corsica.

- Flights to EU, EEA, Switzerland, or within 1000 km of the departure airport.

So for example, a TFFR/Guadeloupe to LEMD/Madrid flight would qualify for this (because it’s going to an airport in the EU).

“Intermediate destination” (€1015):

- Flights to any airport 1000-5500km away, not covered by the above criteria.

For example, a TFFR/Guadeloupe to KTEB/Teterboro flight (approx 2000km).

“Distant Destination” (€2100):

- Flights to any airport more than 5500km away, not covered by the above criteria.

For example, a TFFR/Guadeloupe to KSFO/San Francisco flight (approx 5530km).

How should operators pay these taxes?

The new tax rules say that operators have to work out how much they owe, and declare it using an online portal: https://taxes-aeronautiques.sigp.aviation-civile.gouv.fr/

Until 31 Dec 2025: Operators must submit declarations by the last day of the month following the reporting period (monthly or quarterly).

From 1 Jan 2026: The deadline changes to the 20th of the following month.

There’s also some text saying that if an operator fails to declare or underreports passengers, the DGAC may use aircraft seating capacity to estimate tax liability!

We have had some local reports saying that some FBOs/Handlers have been collecting these taxes from operators, and paying on their behalf. But some others have reported that they’re not doing this as it’s technically illegal. So we’re not sure we would recommend this option at the moment!

Why is France doing this?

The French government have projected these new tax rates to generate €800-€850 million in additional revenue. The country’s new Minister for Public Accounts has given a 👍 to the tax increase –

“I am in favour. It is a measure of fiscal and ecological justice,” she told Le Parisien on Jan 5. “The 20% of the population with the highest incomes are responsible for more than half the expenditure on air travel.”

So there you have it, friends. France hates planes – it’s official.

More on the topic:

- More: French ATC Strike: Sep 18

- More: France Summer BizAv Parking Tips

- More: Heat Damage in Nice: When APU Rules Damage Aircraft

- More: France Wants Your Cash

- More: Slots required at all Paris airports until mid-Feb

More reading:

- Latest: FAA Warns on Runway Length Data and Overrun Risk

- Latest: EASA’s New Cyber and Data Risk Rule for Operators in Europe

- Latest: Airport Spy: Real World Reports from Crews

- Safe Airspace: Risk Database

- Weekly Ops Bulletin: Subscribe

- Membership plans: Why join OPSGROUP?

Get the famous weekly

Get the famous weekly

Hello team, Could you clarify? For flights from Guadeloupe to US, which is the airport of reference, CDG or PTP?

I also participated in creation of this article. Thank you for all the additional details you found.

My reading of this: flights from Guadeloupe (TFFR), the reference airport would be TFFR, not Paris. So flights from TFFR to anywhere within 1000km or flights to Europe would pay the cheapest band of tax. If the flight from TFFR to the US was within 5500km (i.e. most airports in the US), it would pay the middle band (“Intermediate Destination”). But if the flight from TFFR was more than 5500km (somewhere like KLAX for example) it would pay the most expensive band (“Distant destination”).

It is not Illegal to collect French Civilian taxes on behalf of operators.

Flight Pro International France is doing it on behalf of their customers that have accepted to do it.

Declarations are done online EVERY MONTH, so for operators that don’t fly much to France it can be time consuming and can be forgotten ( with possible fines if not done on time ).

Here’s some of the complexity of trying to grasp the real application of this law/new tax.

There is a definition (of sorts) of what flights it applies to. Here’s the French.

« Le service aérien non régulier s’entend de celui qui ne relève pas du 16 de l’article 2 du règlement (CE) n° 1008/2008 du Parlement européen et du Conseil du 24 septembre 2008 établissant des règles communes pour l’exploitation de services aériens dans la Communauté, dans sa rédaction en vigueur. »

https://www.legifrance.gouv.fr/jorf/article_jo/JORFARTI000051168550

Translated, you’ll see it is as clear as mud.

“Non-scheduled air service means that which does not fall under Article 2(16) of Regulation (EC) No 1008/2008 of the European Parliament and of the Council of 24 September 2008 establishing common rules for the operation of air services in the Community, in its current version.”

Notice the detail, that this is for aircraft NOT covered by the EU regulation definition. So what is the EU regulation definition that is referred to? Good question.

Here it is.

https://eur-lex.europa.eu/legal-content/FR/TXT/PDF/?uri=CELEX:02008R1008-20180911

Article 2 Para 16)

«service aérien régulier»: une série de vols qui présente l’ensemble des caractéristiques suivantes:

a) sur chaque vol, des sièges et/ou des capacités de transport de fret et/ou de courrier, vendus individuellement, sont mis à disposition du public (soit directement par le transporteur aérien, soit par ses agents agréés);

b) il est organisé de façon à assurer la liaison entre les mêmes deux aéroports ou plus:

— soit selon un horaire publié,

— soit avec une régularité ou une fréquence telle qu’il fait partie d’une série systématique évidente;

Translated:

“scheduled air service” means a series of flights that has all of the following characteristics:

a) on each flight, seats and/or cargo and/or mail capacity, sold individually, are made available to the public (either directly by the air carrier or through its authorized agents);

b) it is organized to provide service between the same two or more airports:

— either according to a published timetable,

— or with such regularity or frequency that it forms part of an obvious systematic series;

So in effect the French tax law only says that any flights that aren’t scheduled commercial airline flights fall under the business aviation tariffs..if they have 19 seats or less. There is NO definitive mention of private or commercial and the strong implication is that ALL flights with aircraft having 19 seats or less have the tax applied.

Now there is a helpful text in the EU definitions, but it is not referenced in the French tax text.

Article 2 Para 4) would appear to also be relevant, but isn’t quoted in the French tax text.

«service aérien»: un vol ou une série de vols transportant, à titre onéreux et/ou en vertu d’une location, des passagers, du fret et/ou du courrier;

which means:

“air service”: a flight or series of flights carrying, for remuneration and/or hire, passengers, cargo and/or mail;

So the new French tax would appear on reading the actual text, to apply to ALL non-scheduled flights with aircraft less than or equal to passenger seats.

However, that likely isn’t the intention and these draftings get so convoluted by cross referencing so many previous text, actually deciphering the intention can get difficult and then local interpretation becomes more important. After all this is a tax, so the tax inspector decides how he or she applies the rule…and that is definitive unless you want to throw a lot of money and a lot of time challenging their interpretation through the courts.

David, I see that they claim private operators won’t be affected, but I haven’t found this explicitly stated in any regulations. Where are you getting this information from? I’ve noticed several other sources saying the same thing, but I’d like to have a proper legal reference. Thank you!

Hi Ricardo. Here’s the official text: https://www.ecologie.gouv.fr/sites/default/files/documents/Notice_TS_EN_2025.pdf

It’s a tricky one. But I think the exemption of “flights undertaken by a physical or legal person for the purposes of leisure aviation or on their own behalf” sounds very much like private flights!

Selim , I am absolutely astonished by your comment. Like David I am a french citizen, and I have to confess that I am ashamed by the decision taken to increase the 2021 tax rates . It’ s obvious that our government is desperate, given our abyssal debt, to find money by any means necessary.

Inappropriate article ?

Not exactly Selim, this is a factual and relevant article. I am French, and absolutely astonished by our government’s policy against aviation (and business aviation in particular). This will seriously impact this indiustry, and gives once again a very poor image of our country.

Ok, Selim, calm down…

What a surprise when I fell on this article, and it’s « striking title » : FRANCE HATES PLANES !

Let’s ask a pragmatic question : what is the OPERATIONAL aeronautical relevance or benefit of this article ?

Are we in a forum of professional pilots or in a political arena and a fight between Trump and the rest of the world ?

I’m honestly very disappointed, and I’m seriously reconsidering renewing my membership, as I’m not paying for this kind of inappropriate articles.

The article is highly relevant as this is going to affect ALL visitors to France in a jet or turboprop. The legal text is opaque as to if prive aircraft are concerned, but I haven’t seen anything to say they are not, and in fact it is difficult to read the text and interpret that private is excluded…you have to really stretch some of the phrases to apply that interpretation. The straightforward reading is that ALL flights are affected if they have 19 seats or less.

Recent discussions within the French aviation community with the officials has not been able to throw a definitive light on the matter…as the collective response from the officials….’we don’t know…so errr…we’ll investigate and try and find out’. As usually an absolutely horrendously badly written law and a tax not thought through at all implemented by a gang of illiterate schoolkids on crack….that seems to be the way France is run now.

I’ve seen an immediate a direct reduction in flights to/from France..and my own family found it more cost effective to commute from France to UK to take a long haul flight this week. Zero revenue to AF and a win for BA.