The UK Air Passenger Duty Rates are increasing!

What:

Air Passenger Duty rates – a charge for each passenger on flights originating in the UK.

Who:

It applies to fixed wing aircraft weighing 5,700 kg or more (12,500 lbs) and only applies to passengers you have onboard, not your crew. It applies to private non-revenue and charter flights too.

There are some exemptions:

- Emergency, training, military, humanitarian, search-and-rescue and air ambulance flights

- Cargo flights

- Transit passengers possibly

- Tech stops so long as no-one gets on or off

- Not really an exemption, but if a passenger has an onward connecting flight it only looks a the first leg when deciding what to charge

There is also an ‘opposite exemption’ which applies to passengers on flights using aircraft of 20,001 kg (44,094 lbs) or more with fewer than 19 seats. For this they apply a premium rate which is in fact about double the standard business/first class rate.

When:

The new rates come in from April 1, 2023, and will be applied for the tax year 2023-2024. (So if you’re reading this post after March 31, 2024 then this probably won’t be accurate anymore.)

Where:

Everywhere in the UK.

They are based off where the journey ends outside of the UK. “This is their final destination”as HMRC state quite dramatically on their website.

How:

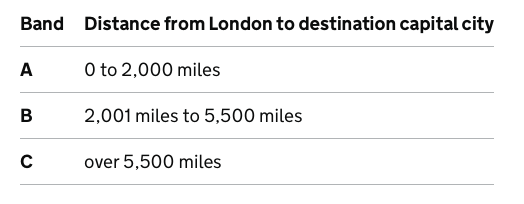

They are introducing new bands – specifically, a new domestic band and a new ultra long-haul band. Current rates will also increase.

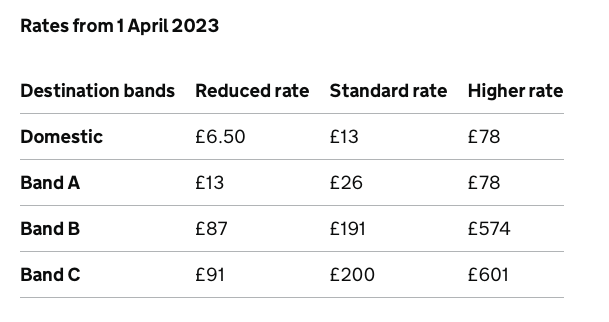

- The new domestic rate will be set at £6.50 (that’s actually been reduced from £13)

- The new Ultra long-haul rate will start at £91

From April 1 there will be 4 (instead of the current 2) bands – Domestic, A, B and C.

Of course, it is the UK so never just that simple. There are also 3 types of rate, based off seat pitch:

- Reduced: seat pitch less than 40″ (1.016m)

- Standard: seat pitch more than 40″

- Higher (the premium rate we mentioned earlier): airplane weighs 20 tonnes or more but has 19 or less seats.

If you go to this page you can see all the destinations and which band they fit into, as well as a lot of info on how to calculate your seat pitch and the rate you need to pay.

So the new ultra long-haul rate is the one that will really sting. This is for flights to countries whose capitals are over 5,500 miles from London, and so that includes key hubs like Bangkok, Hong Kong, Kuala Lumpur and Singapore, where the rate will now be as high as £601 per pax depending on how much leg room they have!

If you want more information then you can find it in several places:

- The HMRC webpage on the changes

- The HMRC webpage for checking specific rates

- Talk to Ann Little on the phone at 03000 586096 or by email: ann.Little@hmrc.gov.uk

More on the topic:

- More: GAR Procedure for UK Flights

- More: London Night Ops: What’s Changing This Summer

- More: UK Electronic Travel Authorization – The BizAv Guide

- More: The 45.5T Elephant in the Security Room

- More: UK Airport Border Force Strikes

More reading:

- Latest: FAA Warns on Runway Length Data and Overrun Risk

- Latest: EASA’s New Cyber and Data Risk Rule for Operators in Europe

- Latest: Airport Spy: Real World Reports from Crews

- Safe Airspace: Risk Database

- Weekly Ops Bulletin: Subscribe

- Membership plans: Why join OPSGROUP?

Get the famous weekly

Get the famous weekly