Effective July 1st, Portugal has introduced a new tax directed at business aviation. If you are operating an aircraft with 19 seats or less, you’ll have to pay the hefty new tax – a G650 operating Lisbon-Newark will get a bill for around €2,000 (US$2,200).

It’s billed as a “Carbon Tax” – ostensibly to mirror the same regulation that has applied since 2021 to airline passengers. However, an airline operating the same route with 250 passengers will only pay €500, despite having a fuel burn three times higher.

As such, it’s better labeled as a Punishment Tax for business aviation.

Tech stops in the Azores are included

If you are planning a tech stop in the Azores (LPLA/Lajes or LPAZ/Santa Maria, for example) – think again. The Azores is “Portuguese Territory” and so covered by the new tax, and the exemption for “technical reasons” doesn’t mean tech stops. So, if you divert in with a fire warning, no tax. If LPAZ or LPLA is your destination, however, you can add about $2,000 USD to your invoice.

You might want to find another NAT tech-stop.

How to calculate your bill

The official regulation is here (Artigo 184.º) – in Portuguese. The basics are:

- From July 2023, a carbon tax is introduced for “consumers of air travel on aircraft with a maximum capacity of up to 19 seats” ,

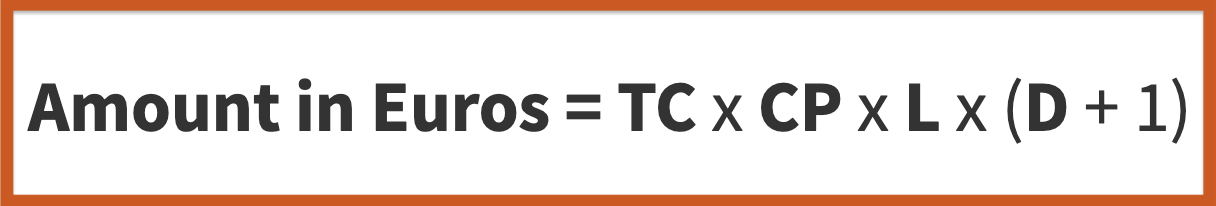

- The amount to pay is calculated as: € (TC x CP x L x (D + 1)). TC is the Carbon Tax (€2), CP is a Coefficient of Pollution (10x), L is the number of seats and D is the distance flown in kilometres divided by 1000.

- The fee applies to each commercial and non-commercial flight departing from airports in Portuguese territory.

- Exemptions: “Fully electric aircraft”, PSO flights, State, Instruction, Medical emergency, SAR, and departures following landings for technical, meteorological or similar contingency reasons.

Examples: G650 Lisbon-Newark, G7500 Azores-Cairo

The formula can be more easily written as:

€20 x Seats x Distance

- A Gulfstream 650 with 14 seats operating LPPT/Lisbon – KEWR/New York Newark: The distance is 5,447km. The charge is thus €20 x 14 x (5.4+1) will get a bill for 1,792 Euro ($2,000 USD).

- A Global 7500 with 19 seats calling in to LPAZ/Santa Maria for gas on the way to Cairo: the LPAZ-HECA distance is 5,223 km. The charge here is €20 x 19 x (5.2+1) = 2,356 Euro ($2,600 USD)

- For comparison, an Airbus 330-200 operating LPPT/Lisbon – KEWR/New York Newark will pay 500 Euro ($550 USD). The charge is simply based on €2 per passenger (250 on board). An A330 will burn about 90,000 lbs of fuel, compared to about 30,000 lbs for a G650. This means that the G650 is being charged about 12 times more in total.

Why is this happening?

Because of the “war” on private jets declared by Greenpeace and other groups. Their aim: tax business jets out of existance.

Although the new tax only came into effect a few days ago, it was signed into law in April 2023. The first few months of this year saw media across Europe pay attention to a Greenpeace “report” on business aviation, claiming massive increases in business jet use using super-flawed data (their baseline was 2020, which wasn’t that busy for some reason). The EBAA countered with some actual facts, but it wasn’t enough to stop the disinformation spread.

In Portugal, the PAN (People, Animals, Nature) political party convinced the government to sign this tax into law as a budget amendment.

So who has to pay, and who doesn’t?

Since this has just come into effect, expect further clarifications and changes, but so far:

👿 Pay the punishment tax:

- Any flight leaving Portgual using an aircraft with 19 seats or less (aka all business jets)

- Irrelevant if commerical or private ops – all must pay

🦄 Exempt from the punishment tax:

- Fully electric aircraft (If you see one flying, let us know)

- PSO flights (A European thing where governments give you money to operate unpopular routes, so they would be charging themselves)

- State flights (The government exempting themselves again)

- Flights wholly operated by reticulated, northern, or southern giraffes (we threw that in, but it makes as much sense as the others)

- Medevac, training, SAR flights, and diversions for unforeseen events

More on the tax

There’s plenty of uncertainty around the new rules for now, but we’ll update this article as we find out more.

- EBAA – Portugal introduces new Carbon Tax

- FCC Aviation – Portugal Carbon Tax

- Original law (in Portuguese)

Do you know more about this? Help us out with any new information! Email news@ops.group or post below in the comments – Obrigado!

More on the topic:

- More: New NAT Doc 007: North Atlantic Changes from March 2026

- More: What’s Changing on the North Atlantic?

- More: Timeline of North Atlantic Changes

- More: Spoofed Before the NAT? Here’s What to Do

- More: Shanwick Delays OCR Until Post-Summer 2026

More reading:

- Latest: FAA Warns on Runway Length Data and Overrun Risk

- Latest: EASA’s New Cyber and Data Risk Rule for Operators in Europe

- Latest: Airport Spy: Real World Reports from Crews

- Safe Airspace: Risk Database

- Weekly Ops Bulletin: Subscribe

- Membership plans: Why join OPSGROUP?

Get the famous weekly

Get the famous weekly

I’ve flown my Phenom 300 several times in and out of portugal in the last year and have not seen this tax added. Has anyone actually been charged yet?

This law doesn’t affect too much business aviation in Portugal anyway.

There are only 3 airports to be considered in Portugal, Beja can also be considered if you accept a 2 hour drive after landing as an alternative to Lisbon.

I have witnessed over the years the implications of the situation of airports in Portugal.

Many important business people with intentions to invest heavily in Portugal didn’t due to the fact there are only 3 airports in Portugal.

As of today if you want to fly to Lisbon with a business jet you may be authorised but just to drop off passengers and depart immediately as there are no parking slots.

So, this law can’t kill something that is already dead.

One of the main problems on the way to reduce emissions is to include the external cost of pollution into prices. In my opinion this is a great example on how to deal with that issue.

The passengers of business jets are in many cases equipped with a significant amount of power (political, financial or moral). They are in part responsible why we are in this mess. There are 4 direct commercial flights per day to the New York area. If your matter is of such urgency, you ought the pay reasonable price for that extra pollution.

If the G650 is fully packed, you will emit 2.7 Tonnes of CO2 per PAX.

1 kg of JetA1 combustion ~ 3kg of CO2

The annual budget per person per year is currently somewhere in the region of 3 Tonnes. However, this budget has to reduce with a rate of 7% per year in order to avoid a heating over 2 degrees Celsius.

https://www.oxfam.org/en/press-releases/carbon-emissions-richest-1-set-be-30-times-15degc-limit-2030

“In my opinion….” I believe we are all allowed to have opinions, even the most nonsense ones.

“Passengers on business jets” … “are in part responsible why we are in this mess”

What mess? Climate change? What about the other periods of climate change where were no business jets??

“…in order to avoid a heating over 2 degrees Celsius”

Again we are all entitled to have opinions but if you believe banning business jets will avoid a temperature increase you should hide yours where nobody can read it

Can you confirm that the complete distance is being used for the calculation?

I find it difficult to believe that the Portuguese authorities would be able to charge a fee outside their jurisdiction. I could imagine the distance flown within their FIRs, including oceanic, which would lower the fees.

The GC distance LPPT-KEWR within Lisbon and Santa Maria FIRs is only 2,632 km (1,008 Euros)

For the LPAZ-HECA flight, the direct route leaves Lisbon FIR after 1,584 km (988 Euros).

If I were affected, I would raise a legal challenge if they tried to charge for the whole distance…

Thank you very much! Finally an information in ENGLISH. And in addition comprehensible. And really great comments on the exemptions…!

Even the Portuguese website about the Carbon Tax does not show anything in English…