If you are a non-EU operator, you are probably already using the Temporary Admission customs regulation when flying to the European Union – whether you know it or not!

It’s always been generally accepted that you trigger the use of this regulation just by filing a flight plan and crossing the external border into the EU, but in July 2020 the EU Customs Code was updated to explicitly ratify this practice.

As we were looking into this latest change and what it meant for operators, we quickly got that sinking feeling you get when you realise you’re about to be engulfed by a world of bafflement and overwhelming complexity. EU customs rules and regulations will do that to you.

So we asked our pals over at OPMAS to break it down for us. What is the Temporary Admission? How does it work? Who does it apply to? What follows below is their quick overview, giving you the essentials of what you need to know in less than 10 minutes.

To start, watch their quick explainer video, and to continue your journey check out their more detailed info below.

The Basic Rule: Any aircraft must come under customs control

Any aircraft flying into the EU will fly under EU customs control either using the Temporary Admission (TA) regulation or full importation. There are no other options. If the aircraft is not already fully imported, the aircraft will automatically be considered as flying under the TA regulation even though the owner or operator have not themselves taken any action to activate the TA regulation or realize that their aircraft is actually flying under the TA regulation. Non-compliance with the TA regulation will most likely activate a direct payment of the VAT (ranging 15-27%) and customs duty (7.7%).

KNOW MORE: See what is actually needed when arriving within the EU?

Who can use Temporary Admission?

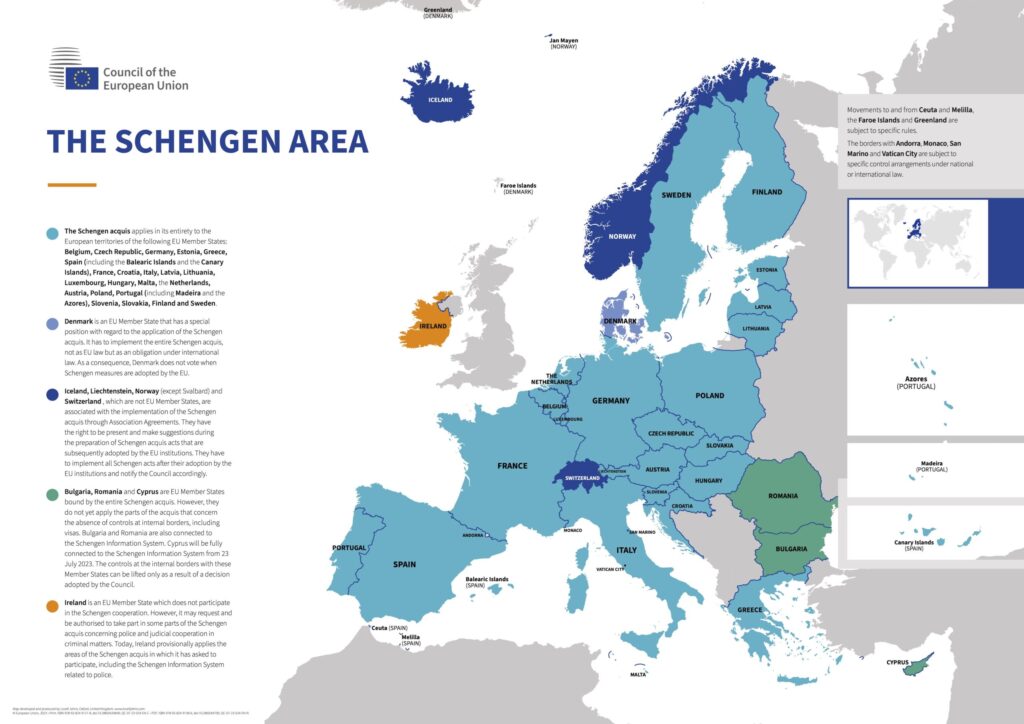

Temporary Admission (hereafter TA) is meant to allow EU outsiders, which means that the aircraft is both owned/registered/operated/based outside the EU (all criteria must be fulfilled), to be able to roam freely within the EU for a certain period. TA cannot be used by EU insiders where the aircraft is either owned/registered/operated/based and mainly used inside the EU (just one criterion must be fulfilled). Mandatorily, EU insiders must use full importation.

Advantages

Most EU outsiders will practically have the same flying privileges as given under full importation as the few limitations do not influence the typical flight and will even give the typical operator more flexibility and extra advantages, such as: unrestricted personal/family/guest use without consequences; and no tax, VAT (Value Added Tax)or duty liability anywhere. Many of these points are often a problem and burden when using full importation.

KNOW MORE: See the quick overview: What you can and cannot do

Disadvantages

There are a few limitations:

1. Flights where the aircraft will be used for passenger transport subject to an individual and personal ticket fee or direct payment

2. Commercial freight items are not allowed

The below descriptions also include other matters that must be handled the correct way.

The basic preconditions for EU outsiders

TA can only be used if the aircraft is owned by and registered to a non-EU entity and further operated by a non-EU operator. The aircraft must also have its normal fixed base outside the EU. The term ‘non-EU’ relates to anything other than the 27 EU member states and related customs areas as the Isle of Man and the Channel Islands (at least until Brexit has become a reality).

KNOW MORE: The 27 European Union member states and special member state territories

Private or commercial use

The TA regulation distinguishes between private use and commercial use; where private use in general offers more privileges and flexibility than commercial use. There has been some earlier confusion about these forms of usage under TA, but the 2014 working paper from EU Customs Code Committee gave some clarification of these definitions where upon the modern use of TA is based. This description only describes private use of an aircraft.

KNOW MORE: See the quick overview: Private or commercial use of aircraft

When do the restrictions start?

Any EU outsider can fly to one EU destination without any consequences, if the next following flight is to a destination outside the EU. The restrictions are only related to internal flights within the EU.

What about the VAT and the customs duty?

Both the VAT and the customs duty is suspended as long the preconditions for TA is fulfilled. A violation will activate a full payment of these taxes.

KNOW MORE: See the quick overview: Customs duty and end-use exemption

When is TA used?

Any aircraft flying within the EU must somehow come under EU customs control using either TA or full importation, there are no other options. So, if the aircraft is not already fully imported, the aircraft will automatically be considered as flying under TA.

KNOW MORE: See the quick overview: What to do?

When is TA activated?

The use of TA regulation is activated (knowingly or not) every time an un-imported aircraft crosses EU’s external border on an entry and is terminated again when the same aircraft is crossing the EU’s external border on the way to a non-EU destination.

The grey zones – owned by?

Most aircraft used or indirectly owned by a high net-worth individual are directly owned by non-EU SPV. This is basically fine as long as this individual does not have their official place of residence or their centre d’affaires within the EU or is registered as a tax resident.

The grey zones – EU entities involved?

We recommend that no EU entities are part-owners or a part of a leasing structure (like a sublessee) for an aircraft using TA.

The grey zones – EU base, long-term parking or not?

The aircraft must have its fixed base outside the EU and spend the majority of time outside the EU, but certain facts can indicate that the operator or aircraft has become ‘resident/domiciled’ in an EU airport even though an official home base is established outside the EU. The TA regulation cannot be used as a circumvention of the import for free circulation by predominately using the aircraft within EU as opposite to outside the EU.

KNOW MORE: What is the limit for multiple continuous stays at the same place?

Which entity is actually ‘using’ the aircraft?

The users of the aircraft are actually the pilots (read: the operator of the aircraft) according to the 2014 working paper from EU Customs Code Committee. Most lay persons would probably think that the user of an aircraft would be the owner entity or the passengers, but the pilots are actually considered to be the users in a customs context.

Which entity must be the declarant?

The declarant must always be the entity who is truly operating (physically piloting) the aircraft. No other entities are allowed to be the declarant. If the aircraft is managed, the management company is normally considered to be the correct declarant in customs terms. Please be aware, that the ‘operational control’ definition related to the use of TA in the EU is not the same as the FAA’s definition which means that the typical entity with the FAA’s understanding of operational control is often not the correct declarant when using TA in the EU.

KNOW MORE: See the quick overview: Entity responsible for flight in the European Union

KNOW MORE: Which entity is allowed to be the declarant?

How can the aircraft be used?

The aircraft can be used for any business or non-business purposes (as Part 91) according to the 2014 working paper from the EU Customs Code Committee.

KNOW MORE: See the quick overview: Aircraft usage

EU resident passengers on flights within the EU

EU resident passengers are allowed according to the 2014 working paper from the EU Customs Code Committee.

EU resident pilots on flights within the EU

EU resident pilots are allowed according to the 2014 working paper from the EU Customs Code Committee but only if the pilots are directly employed by the declarant.

Non-EU resident passengers and pilots on flights within the EU

There are no restrictions.

Does the owner of the aircraft have to be on board or present in the EU?

According to Danish interpretation and the 2014 working paper from the EU Customs Code Committee, an aircraft under TA is used by the person who acts as the pilot and not by the passengers. Accordingly, the presence of the aircraft owner/registered party is not needed in most cases unless the aircraft is occasionally borrowed and used by an EU-resident person, who acts as the pilot. This rule is meant for smaller aircraft without hired pilots. Furthermore, the EU Customs Code Committee have also confirmed in one of its earlier minutes/summary records that any restrictions for EU residents only refers to the pilots on board.

What is a non-EU aircraft registration?

Aircraft registered in the 27 EU member states and related customs areas are not eligible for TA, but any other aircraft registration will work. This disqualifies aircraft registrations from the Isle of Man (M) and the Channel Islands (2/ZJ) at least until Brexit has become a reality.

KNOW MORE: See the quick overview: Aircraft registration

KNOW MORE: SURVEY 5: Does the nationality of the aircraft registration matter?

Period of stay within the EU

A stay is limited to a maximum of 6 months per entry. Multiple continuous stays are allowed as long as the aircraft is roaming around within the EU. We will advise any operator to check whether or not the preconditions for TA are still fulfilled, if the aircraft often tends to stay at the same location – or stay close to or more than 50% of the time within the EU. Please also see the above paragraphs about grey zones for owner entity and base.

KNOW MORE: See the quick overview: Period of stay in the European Union

KNOW MORE: SURVEY 7: How is the 6 months period of stay practically interpreted?

Demand for documentation?

The operator must always be able to document the flight pattern within the EU.

How to document a flight?

A form called the ‘Supporting document for an oral customs declaration’ can be used to document the entry and the exit. The operator should also document the flight pattern within the EU with EUROCONTROL records and the operator’s own flight records. Furthermore, the operator should always have records of all relevant EUROCONTROL charges and a total flight list. The use of the ‘Supporting Document’ can be beneficial but is not mandatory.

KNOW MORE: BREAKING NEWS: See what is actually needed when arriving within the EU?

What is the function of the ‘Supporting Document’?

A customs stamp on the ‘Supporting Document’ only serves to acknowledge that the aircraft has arrived and/or eventually exited the EU. The stamp does not mean that customs have accepted any use or the aircraft set-up as TA compliant. It is a common misunderstanding that the use of this form gives the operator/aircraft some kind of free circulation status for the next 6 months or a carte blanche to fly freely within the EU without meeting any preconditions. Even though the form is used, the operator is still obligated to comply to the TA regulation continuously when flying within the EU.

What is the validity of the ‘Supporting Document’?

The form is only valid as long as the aircraft has not left the EU, and for a maximum of 6 months. A new form must be stamped upon the next entry (even though there is still some time left within the 6 month period). The 6 months mentioned here is the maximum stay of the specific entry whereupon the form is stamped (in customs terms = period for discharge). Again, it is a common misunderstanding that any future entries into the EU can be endorsed in advance by using this form.

KNOW MORE: Is a Supporting Document valid for one EU-trip or multiple EU-trips within 6 months?

Commercial group charters

This is allowed according to the 2014 working paper from the EU Customs Code Committee as long as the aircraft is used in the EU for passenger transportation without a ticket fee/direct payment. This means that a commercial group charter (as Part 135) is treated in customs terms as private use as long as the mentioned preconditions are met, even though the same flight is treated as commercial use according to the aviation regulators.

Traffic rights

Commercial non-EU operators will still need traffic rights where they are normally needed. A customs handling like an importation/admission will not influence any of the demands for traffic rights anywhere in the aviation regulation.

How to be ready to use TA?

Here’s what to do:

- Check that the basic preconditions are fulfilled

- Understand the limitations and subjects that must be handled correctly

- Have the relevant paperwork ready on board the aircraft in order to document the correct use of TA

- Instruct the pilots so that they are ready to handle a customs ramp check

How can an operator secure all positions?

OPMAS can help non-EU operators to check whether or not an aircraft operation is complying to the TA regulation. The important matters are simply to secure compliance and thereafter set-up a system to document that the preconditions for the TA regulation are fulfilled continuously and that the pilots have the correct paperwork ready for a customs ramp check.

Always ask first

Our advice has always been to ask the local tax authorities for a binding advance tax ruling prior to any importation/admission in order to eliminate any doubt about the outcome. All cases have different details and a binding advance tax ruling will also consider all new European Court of Justice (ECJ) judgements. Even if you have a fully working set-up, we believe, an importation/admission without a binding advance tax ruling from the EU member state into which the aircraft is to be imported, is too great a risk to take. Many of the above-mentioned points/uncertainties could easily be covered by simply asking and you should walk away from any service provider that refuses to provide a binding advance tax ruling.

Tax havens and the Paradise Papers

A few EU member states handle aircraft admission/importation differently. These states do not follow the EU standards or guidelines, and this is often sanctioned by their local tax/customs authorities in order to offer a better business environment or to create local gateways for certain industries. These jurisdictions are known to bend the rules in favor of local companies often by only implementing a light version of any new regulation or by simply ignoring or delaying the required implementation. The Paradise Papers have highlighted some of these EU tax havens. These jurisdictions and related industries will without any doubt have the full attention of several national and EU authorities in the future. We will see many changes and audits of the regulation in the future, thus no one should import an aircraft without a binding advance tax ruling.

Denmark as a jurisdiction

Denmark has the very best reputation both within the EU and worldwide and is the number one on the Transparency List over the least corrupt nations in the world. We are known always to implement all EU-directives promptly and 100% by the book without any bending of the rules in favor of local companies. Denmark is the only EU member state that is known to facilitate aircraft importation and admission for non-EU operators where the member state is not considered a tax haven.

Thanks to Frank Hansen at OPMAS for this post. To get in touch with OPMAS for more info on any of the above, contact: info@opmas.dk